An investor is comparing two bonds – When making investment decisions, it is crucial to carefully compare bonds to identify the most suitable options. This guide provides a comprehensive analysis of the key factors investors should consider when comparing two bonds, empowering them to make informed choices.

By examining yield, maturity, credit risk, and liquidity, investors can gain a thorough understanding of each bond’s characteristics and potential returns. This analysis enables them to align their investment strategies with their financial goals and risk tolerance.

Bond Comparison Factors: An Investor Is Comparing Two Bonds

When comparing bonds, investors should consider key factors that influence their value and risk profile. These factors include:

- Yield:The annual return on a bond, expressed as a percentage of its face value.

- Maturity:The date on which the bond matures and the investor receives the principal amount.

- Credit rating:An assessment of the issuer’s ability to repay the debt, which affects the bond’s risk level.

- Liquidity:The ease with which a bond can be bought or sold in the market.

Yield Analysis

Bond yields can be classified into different types:

- Current yield:Annual interest payment divided by the current market price.

- Yield to maturity (YTM):The annualized rate of return an investor will receive if they hold the bond until maturity.

To calculate YTM, investors use the following formula:

YTM = (C + (FV

PV) / N) / ((FV + PV) / 2)

Where:

- C = Annual coupon payment

- FV = Face value

- PV = Present value

- N = Number of years to maturity

Maturity and Duration

Maturityis the date on which the bond matures and the investor receives the principal amount. Durationmeasures the weighted average time until an investor receives all cash flows from the bond.

Maturity and duration affect bond prices and yields as follows:

- Longer maturity bonds typically have higher yields.

- Longer duration bonds are more sensitive to interest rate changes.

Credit Risk Assessment

Credit risk is the risk that the issuer will default on the bond payments. Investors assess credit risk by considering the following:

- Credit rating agencies:Organizations that evaluate the creditworthiness of issuers.

- Bond covenants:Legal agreements that protect investors’ interests in case of default.

Credit ratings range from AAA (highest credit quality) to D (default). Higher credit ratings indicate a lower risk of default and lower yields.

Liquidity and Marketability, An investor is comparing two bonds

Liquidityrefers to the ease with which a bond can be bought or sold in the market. Liquidity is important because it allows investors to adjust their portfolios quickly.

Factors affecting liquidity include:

- Trading volume:The number of bonds traded in the market.

- Bid-ask spread:The difference between the bid price (price at which investors are willing to buy) and the ask price (price at which investors are willing to sell).

Bonds with high liquidity have lower bid-ask spreads and are more easily traded.

Query Resolution

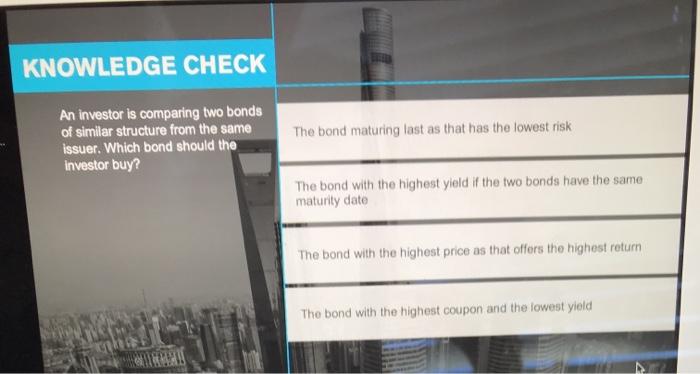

What are the most important factors to consider when comparing bonds?

Key factors include yield, maturity, credit risk, and liquidity. These factors provide insights into the bond’s potential returns, duration, safety, and ease of trading.

How do I calculate and compare bond yields?

To calculate yield, divide the annual coupon payment by the bond’s current market price. Compare yields to determine which bond offers a more attractive return.

What is credit risk and how do I assess it?

Credit risk refers to the possibility of a bond issuer defaulting on its payment obligations. Assess credit risk by reviewing the bond’s credit rating, which is assigned by credit rating agencies based on the issuer’s financial health and ability to repay debt.